Forum Replies Created

-

AuthorPosts

-

Hi Geoffrey,

The ‘Standard’ calculation is is based on income only. So should be done based on Gross bank interest.

Hope this helps.

Darren

Hi Sue,

From my experience, billing is driven by the fee earners/secretaries in the small to medium sized firms. That said, I am hearing of more and more medium firms moving towards centralised billing. In the larger firms, it tends to be a designated billing team.

What practice management system are you currently using? Is the intention to completely remove the fee-earner from the process?

I will pose this question for you on our next Social Support Team meeting on the 26th of this month to gage what others are currently doing.

Hi James.

Not sure I follow the requirement. Are you saying you receive an invoice from a supplier that states certain items are just 0% i.e. not stating whether it’s Zero Rated, Exempt or Outside the Scope of VAT? So when you’re posting to Partner, you’ve no idea what VAT rate to analyse them against?

Cheers

Hi John,

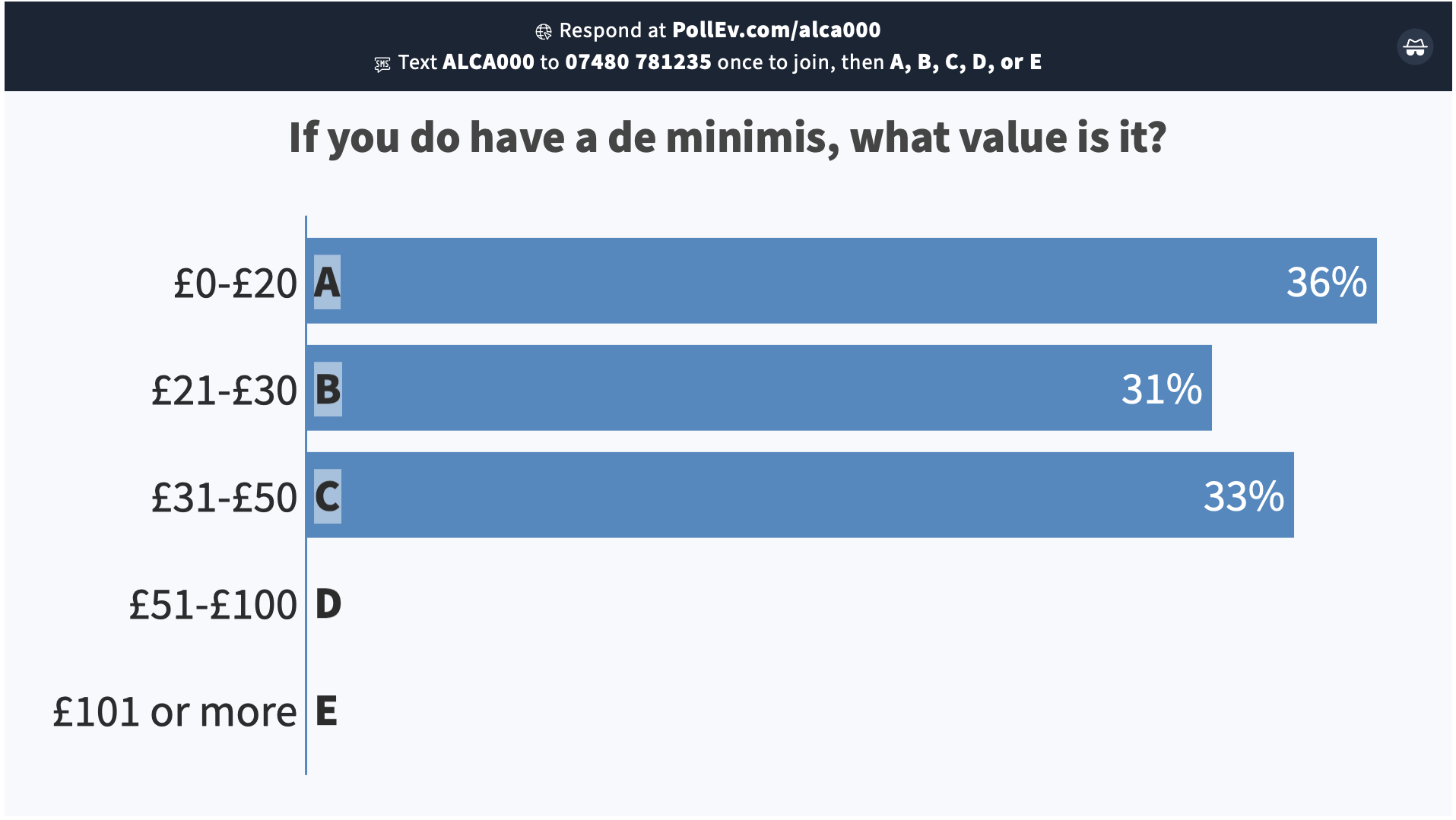

We hosted a compliance forum yesterday and I posed this question to a group of around 70. This was the result. Hope it helps.

Darren

Pleasure 🙂

Hi Jane,

That was my view as well.

Just be mindful, there is no requirement to keep the financial affairs separate if they have a joint account or own a property, jointly.

“You must keep the donor’s finances separate from your own, unless you’ve already got something in both of your names like a joint bank account or you own a home together.”

https://www.gov.uk/lasting-power-attorney-duties/property-financial-affairs

Cheers

Hi Jane,

Do they own a home together?

Hi Sarah,

The Place of Supply Rules don’t really go into any detail around this but I can confirm from previous conversations with HMRC, they would expect the work to be apportioned and the invoice to reflect that. In your situation, you’re acting for two executors where one is in the UK (subject to UK VAT) and the other outside of the UK (Outside the Scope of UK VAT) so the invoice/bill should be reflect that and be split i.e. 50% taxable at standard rate and the other 50% as Outside the Scope of UK VAT. I’d recommend you issue two separate invoices in this situation for clarity.

VAT is always fun – NOT!

Hope this helps

Hi Josie,

I asked the SRA to confirm this recently and the answer was “no change”.

Hope that helps.

Not a straight forward answer, I’m afraid.

The answer very much depends on what input the agency has when obtaining the policy. British Airways v Prosser Court of Appeal case highlighted that agencies like search agencies and medical reporting agencies should in fact be charging VAT on the total supply to the instructing solicitor.

“Where an agency acts as a mere ‘post-box’, obtaining and forwarding documents for a specific fee, the actual cost of the documents will usually represent “expenditure incurred in the name of and on behalf of” a client i.e. a disbursement with no VAT.

Where an agency plays a more active role (e.g. by vetting experts, having input into how a report is prepared, quality checking etc.), it is less likely to have acted as a mere post-box. Where the agency has done substantially more than act as a post-box, the cost of the documents is not “expenditure incurred in the name of and on behalf of” a client. The expense will instead have been incurred by the agency “in the course of making its own supply of services … and as part of the whole of the services rendered by it. VAT will therefore be payable on everything that the agency invoices, not just its own “fee”.”

So if the agency has merely acted as a ‘post-box’ and has billed the policy to you with no VAT, then you can treat it as a disbursement to your client with no VAT.

If the agency has not acted as a ‘post-box’ and has billed the policy to you with no VAT, then then you cannot treat it as a disbursement when billed to clients. It should be treated as a recharge subject to VAT.

Where we’re obtaining indemnity policies using agents, you need to have a conversation with the provider to understand what input they have when obtaining them. Only then can you make a decision as to how they’re passed on to your clients.

I hope that helps.

Hi Debbie,

I think this is great news. The amount of issues Rule 2.1(d), Rule 4 and 10 causes some firms, was significant. At least moving the guidance into to rules clarifies that it’s not guidance per se.

Hi Tanya,

From memory, where firms have many bands and schemes, it was easier to use the export and import functionality to manage them i.e. export out into Excel, make changes and import back in.

Hi David,

This link will help you.

https://www.companydebt.com/winding-up-petitions/has-a-petition-been-issued/#toc_0

Cheers

Darren

Hi Michelle

“Easy” – I wish!

That said, Brexit simplified services to overseas clients.

If your service doesn’t relate to UK land then the supply is outside the scope of UK VAT – so no VAT on the bill.

Make sure the sale is still included on the VAT Return under box 6.

Hope that helps 🙂

No problem 🙂

It’s also good for fee-earner’s as ultimately, it’s the fee-earner that knows why they’ve incurred the cost/instructed the supplier and not finance. The fee-earner needs to provide sufficient information/narrative when requesting client related payments so that finance can then treat the cost correctly when processing to the accounts and when billing.

D

-

AuthorPosts